Amid the healthcare industry’s continued shift toward value-based care, Accountable Care Organizations (ACOs) have emerged as one of the most significant models for physicians’ groups seeking to adapt to a new set of financial opportunities and regulatory realities.

What is an ACO?

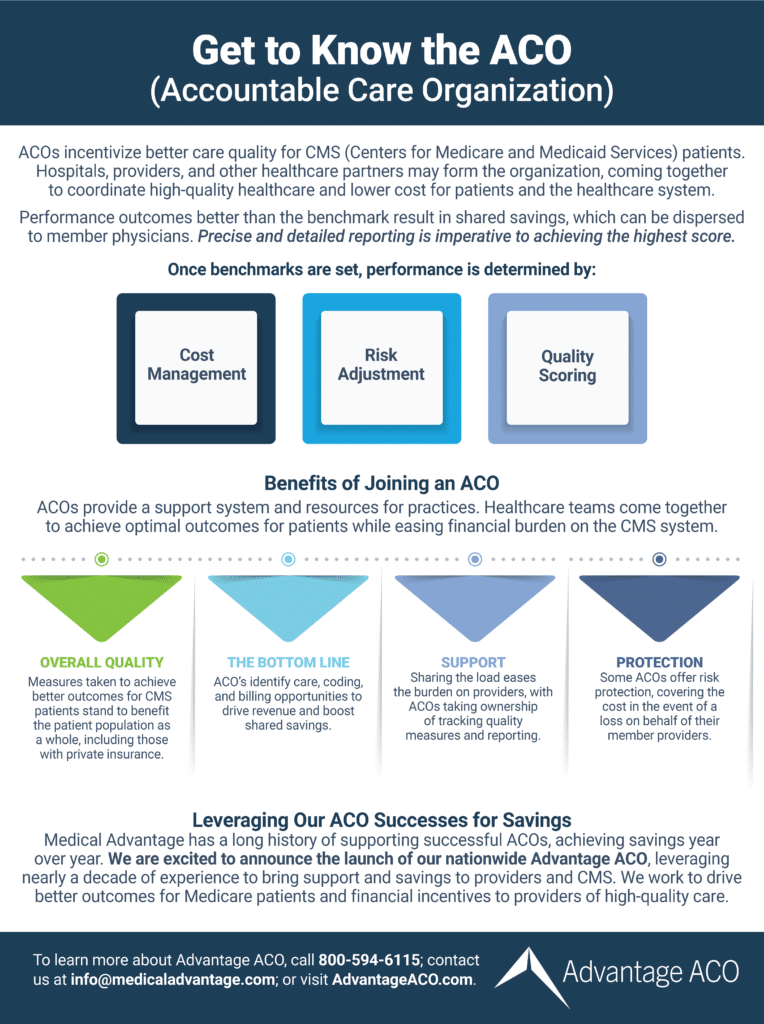

The ACO model aims to bolster group performance, reduce costs, increase payer reimbursements, and improve care quality for patients. They achieve this by both providing resources to improve member practices’ operations and integrating patient care networks closer together.

As established within the Centers for Medicare and Medicaid Services (CMS) Medicare Shared Savings Program (MSSP), ACOs are groups of physicians and primary care providers responsible for Medicare patients. ACO member services promote a more coordinated and integrated group of providers with enhanced communication within a patient’s care ecosystem.

Today, physicians have more ACO options than ever before. But while the benefits of ACOs are well known, the financial setup that enables their performance can be somewhat confusing. How exactly does the ACO payment structure work?

Understanding How the ACO Financial Model Works

The ACO financial model (also called the ACO payment structure) is a blend of incentives, shared risk, and evaluation based on quality metrics. The outcome determines the number of reimbursements or shared savings accrued or the number of penalties (when there is poor performance).

Providers who are members of ACOs receive fee-for-service payments throughout the performance period (volume-based care rather than value-based care). Then, at the end of the performance period, these payments are adjusted based on the ACO’s care quality performance.

In past models, payers had sole responsibility for care quality and patient outcomes. However, with the ACO model, risk, rewards, and responsibilities concerning care quality measures are increasingly shared by a patient’s care providers as well as payers.

How is Care Quality Measured?

Standardized benchmarks set by CMS (known as Electronic Clinical Quality Measures or Web Interface Quality Measures, respectively) assess quality scores. This same quality performance also determines whether or not the ACO and its members are eligible for shared savings.

Factoring Upside and Downside Risk

In addition to upside-risk only contracts, providers now have the option of entering into upside-downside risk contracts, also known as two-sided risk contracts. With these contracts, the more potential risk ACO’s take on, the more potential shared savings they can earn.

By contrast, upside-downside risk makes providers more fully accountable for both good and bad care quality performance. For better or worse, CMS is pushing ACOs and providers in general toward these models and taking on more accountability for care.

Accepting increased responsibility, risk, and financial culpability for patient outcomes will become increasingly necessary for providers as healthcare moves away from fee-for-service and towards fee-for-value. While this will be uncomfortable for many providers, the potential for increasing both revenue and patient outcomes in these models is high.

Still, many providers are understandably hesitant about taking on increased risk. The Advantage ACO eliminates worries about potential penalties in two-sided risk arrangements by fully covering any incurred downside risk— while distributing shared savings to member providers.

Risks, rewards, and responsibilities concerning care quality measures are all shared by a patient’s care providers as well as payers within the ACO payment model.

To learn more about the Advantage ACO, its benefits, and how to join, click here.

The ACO Shared Savings Model

While ACOs may differ in which type of risk arrangement they enter into, one aspect they all have in common is they are part of the Medicare Shared Savings Program (MSSP). It is within the MSSP the ACO payment model structure takes shape.

“The Shared Savings Program is committed to achieving better health for individuals, better population health, and lowering growth in expenditures. The Shared Savings Program is an important innovation for moving … away from volume and toward value and outcomes,” explains the CMS on its website. “It is an alternative payment model that promotes accountability for a patient population, coordinates items and services for Medicare FFS (fee-for-service) beneficiaries, and encourages investment in high quality and efficient services.”

In short, the MSSP incentivizes providers by rewarding those who perform well in value-based care models. ACOs support providers in delivering enhanced care, and in turn, shared savings encourage providers to strive for better and more cost-effective care. This is a win for both the CMS and care providers— less waste spending and more savings— and for patients who enjoy better care outcomes.

With ACOs, everyone wins – the government avoids wasteful spending, care providers get better reimbursement and increased spending, and patients get better quality care.

How ACOs Are Aiming to Achieve Higher Care Quality

The goal of realigning and restructuring healthcare models, in general, is to achieve higher care quality and patient outcomes, and ACOs are a fine example of this. While entering into new contracts and models are often difficult for providers, ACOs and ACO payment structures are already proving to be effective models for delivering higher care quality.

How is it, then, that ACOs can provide better care than some of their fee-for-service predecessor models? Again, it all starts with the way ACOs integrate and bring together the patient care network.

The Drive for Better Integration and Cooperation

The American Hospital Association defines ACOs as “groups of clinicians, hospitals and other health care providers who come together voluntarily to give coordinated high-quality care [to] a designated group of patients.” The key phrases in this definition are “coordinated” and “high-quality.”

Disappearing are the days of fragmentation in healthcare, where a patient’s primary care provider and network of specialists were often not on the same page, or even aware of what the other was doing. ACOs are ushering in a new era of cooperation and shared responsibility for patient well-being among providers, resulting in better outcomes and increased profits.

The ACO reimbursement model (with the possibility of shared savings) drives increased cooperation. The negative adjustment from downside risk also motivates care providers to close gaps in care and do everything possible to deliver patients the best care possible.

In an ACO, “clinicians, hospitals, and other healthcare providers,” come together and coordinate to achieve a higher level of care quality for the CMS patient population. This can deliver better care outcomes for the whole patient population.

How Do ACOs Play a Role in Value-Based Care?

By serving as a catalyst for providers to improve care quality and reduce costs, the ACO along with the ACO payment structure is one of the foremost tools and models driving the industry-wide shift toward value-based care.

Via a series of metrics known as performance measures, the CMS benchmarks the performance of ACOs against the national average to determine ultimate reimbursement (or penalty) from that performance. Reimbursement tied to care quality and not care quantity continues to drive the industry toward optimal patient care outcomes.

Advantage ACO Can Help

With decades of healthcare performance, technology, and analytics expertise, Advantages ACO’s consultants assist participating practices in optimizing cost and utilization performance, with data-driven interventions and recommendations. See how the Advantage ACO can help your healthcare group succeed and thrive amid the shift to value-based care. For more information, click here.